Apple DCF Valuation

Lets Value Apple Like a Wallstreet Analyst

About:

Apple manufactures smartphones, tablets, PCs, software and peripherals for a worldwide customer base.

Price Catalysts

Apple is not a hardware nor a services company, it is a closed ecosystem which caters to all the needs from a consumer. The addition of services such as Apple TV, Apple Pay (buy now pay later – credit card replacement), and Apple’s resource allocation to EV cars shows Tim Cook’s strategy of further growing Apple’s ecosystem and it is the adoption of this ecosystem that will drive ultimately Apple’s value.

New Product Launches with improved processors:

iPhone 13

Switch over to 5g should help with sales

MacBooks

Apple is widely rumored to be readying new 14-inch and 16-inch MacBook Pro models.

New stronger MacBook processors. Apple’s previous M1 chips used in the MacBook’s only supported one external display. The new M2 chip will continue to integrate CPU, GPU and the Neural Engine on the same chip and support multiple displays

Growth in Services revenue (Better Margins as services cost less compared to hardware):

Apple TV: Competitive market (Disney, Netflix, HBO) but Apple has so far been quite successful with 35 Emmy nominations.

Apple Pay:

Apple is planning to launch its own 'buy now, pay later' service allowing users to pay for any Apple Pay purchase in installments. If the revenue model is like that of Klarna then Apple should make money from late payers and fee charges from merchants.

Retailers report as much as a 50% increase in sales after adding BNPL at the checkout, this should drive sales overall

Apple Arcade: Similar model to the highly Xbox Games Pass model, this is Apple’s premium subscription gaming service, £4.99 per month.

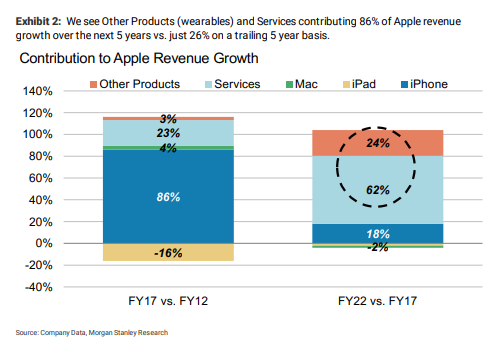

The growth in services should ultimately increase Apple’s operating margins, I expect Apple to reach 35% revenue share from services circa FY2025. This is a very conservative estimate given other equity research reports such as Morgan Stanley estimates this figure will increase to 62%

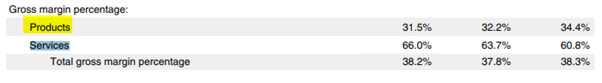

Apple gross margin from services is far higher, we can assume then operating margins will improve as services contribute to a larger percentage of Apple’s revenue

Apple Valuation

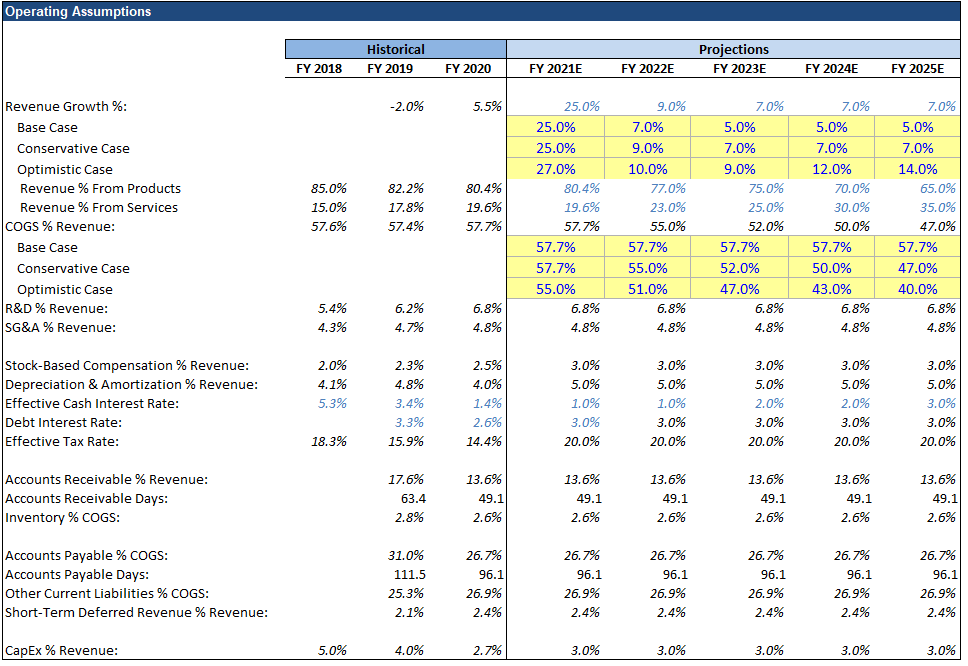

Base Case

Apple’s revenue growth in FY2022 should retract back to single digit growth numbers as demand dies down to due covid stabilizing and supply chain/ semiconductor shortage issues improving

Conservative Case

Expect margins to improve as apple moves to more of a software business

Services will account for 35% of Apple’s revenue by end of FY2025

Optimistic Case

We assume services will account towards 55% of Apple’s revenue and COGs reduces to 40% of revenue as service products cost far less to make compared to physical goods

We see Apple starting to take reservations to the highly anticipated Apple Car in FY2022 with deliveries in FY2023 causing YoY revenue to improve moderately rather than decline.

Tesla cybertruck’s 1mn preorders if fulfilled will be worth around £80bn. Using this as a proxy we can estimate Apple’s preorder numbers. Here we assume Apple prices its car at 50k and delivers 40k cars in FY2023, 80K in FY2024 and 130k cars in FY20 resulting in rev circa 12.5bn assuming sale price of 50K

Apple Operating Assumptions

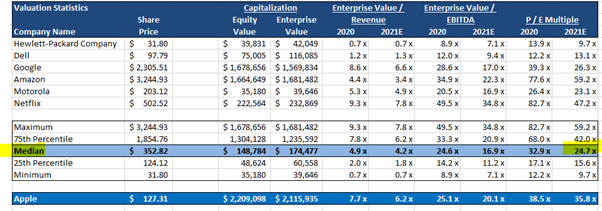

Apple Comps

We want to see how Apple is valued by the market compared to its peers so a comps analysis is needed where we compare P/E and EV/EBITDA multiples to see how Apple ranks compared to its competitors.

Currently Apple has a EV/EBITDA multiple of 25.1x which is around the median range. This makes sense as Apple isn’t as asset light compared to the likes of Netflix/Google but isn’t a resource intensive as HP/Dell where revenue is largely from sales of PCs and printers.

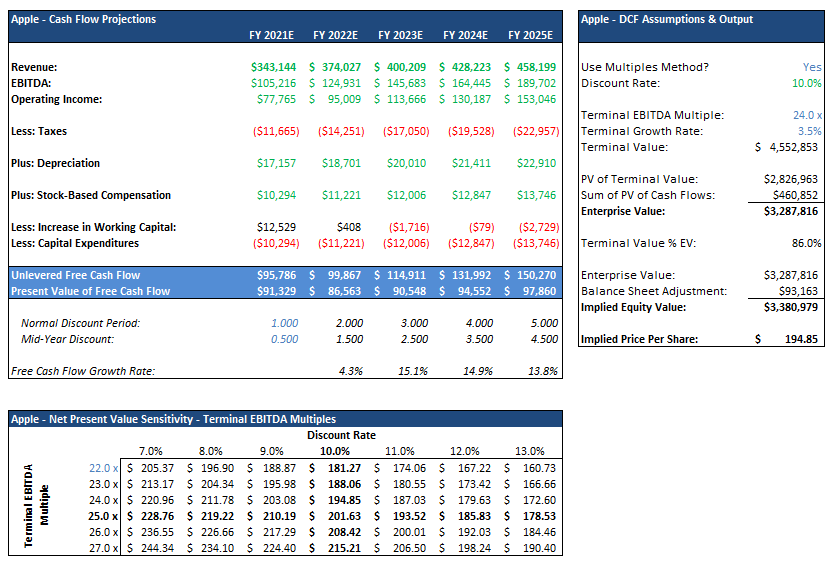

Apple DCF - Conservative Case: $194

Running a quick DCF on the conservative case implies a price of $194 per share. On this DCF we used a discount rate of 10% to be conservative. The WACC calculation on the model implies a rate of 5.64% for Apple which we thought was far too low given we are in low interest rate environments which will distort valuations.

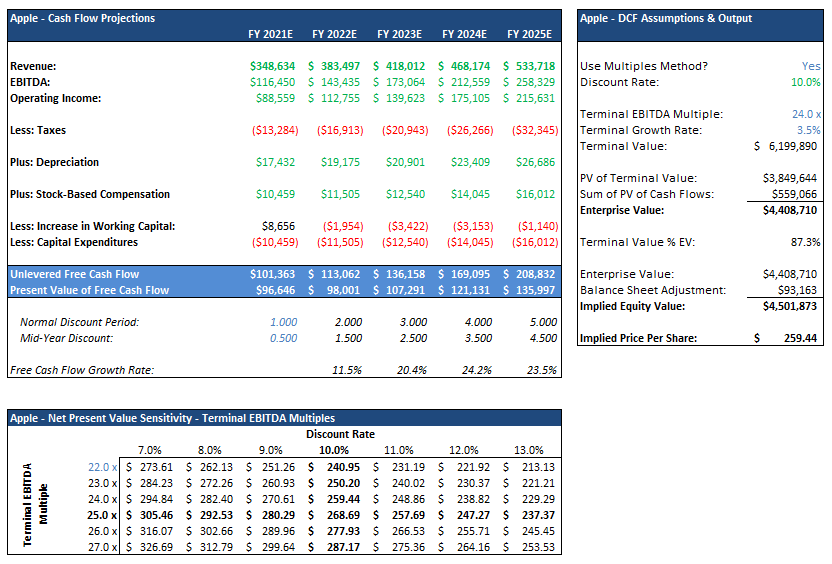

Apple DCF - Optimistic Case: $259